Optimising my FIRE Journey

Today I wanted to look at optimising my FIRE journey. Basically, I have these forecasts set on a couple different areas and I wanted to see if there was a way where I could optimise my strategy to potentially reach FIRE sooner or reach it in a stronger position.

I still have a lot I want to achieve before I finally pull the trigger on FIRE, and while I do not have a specific date that I NEED to hit, I would like to do it as soon as possible (not that I really dislike my work or anything, but I would just prefer to have the freedom if possible).

I have done a couple of posts before about this kind topic, including this one here:

The above post goes into a bit more detail about some of the Milestones I want to achieve for my FIRE, but it does not look into the forecasting as much as this one will.

I also have this post here:

Buying my Retirement PPOR – Now or Later?

In this post I came to the conclusion that it would be a financially better alternative to purchase my PPOR now and have it as an IP until I am ready to move in.

The last post is this one:

When To Sell My Investment Properties

I built a spreadsheet which optimised my returns on the date of selling my investment properties. This was built in isolation with investment returns of the properties, so it does not take everything into account that this post will do.

Current FIRE Date

My current FIRE Date is 5/1/2027 – the significance of this date is it is my 40th Birthday, and I think it would be a nice achievement to reach FIRE by the time I am 40. Definitely not as fast as some people within the FIRE community, but I learnt long ago that there is no use comparing yourself to other people. If I was able to reach FIRE by this date it would be a significant achievement and I would be incredibly proud of myself.

Like I said, this date is not set in stone. If I reach it earlier, then that is amazing, if it is delayed by a little while, then that is no problem and not the end of the world. At the moment though, that is the goal, and I am going to do my best to achieve it.

FIRE Requirements

I currently have the following FIRE requirements that I will want to have achieved before I do finally pull the trigger and reach FIRE:

- $1,000,000.00 Net Worth in my share portfolio

- A PPOR owned outright with no debt

- $250,000.00 in my Superannuation (however I will not be looking at that side of things in this spreadsheet)

- $40,000 in cash savings (annual expenses) prior to pulling the trigger

Now I just need to look at my current situation to determine if it is a realistic goal to have in mind.

Spreadsheet Inputs

There will a few assumptions I will need to make to try and forecast the future, but I do try to at least be as conservative as possible to prevent any overly optimistic expectations down the line.

General Inputs

Current Share Portfolio: $219,000.00

Property Selling Costs: 5.00%

Monthly Savings: $2,500 (this does not include my investment properties)

Shares Return: 6.00% per annum (I am not including inflation)

Coast FIRE Start: 11 months (this is the time when I will stop investing in shares and instead focus on paying down the PPOR mortgage ASAP)

Investment Property 1 Inputs

Current House Value: $550,000.00

Capital Appreciation: 2.50% (I believe this to be fairly conservative and just inflation)

Sell Date: 1/3/2026

Loan Amount: $195,000 (again I am being somewhat conservative and am not assuming any principal will be paid down)

Monthly Savings: $1,200.00 (this is the income generated from the property after all expenses have been paid)

Investment Property 2 Inputs

Current House Value: $450,000.00

Capital Appreciation: 2.50% (I believe this to be fairly conservative and just inflation)

Sell Date: 1/7/2026

Loan Amount: $277,000 (again I am being somewhat conservative and am not assuming any principal will be paid down)

Monthly Savings: $1,250.00 (this is the income generated from the property after all expenses have been paid)

PPOR Inputs

Purchase Date: 1/1/2022

Property Value: $325,000.00

Principal: $260,000.00

Interest Rate: 2.70% per annum (this one is a bit of a risk as it could very start rising, but given the short loan term I think it will be okay)

Net Monthly Rent: $1,000.00

Disclaimer:

The deposit and purchasing costs for the property will be coming from my existing savings in my offset account, as well as what I currently have in my US Bank Accounts. This will not be coming from my share portfolio.

I also have not taken into account capital gains associated with selling the properties, my first investment property will have negligible (if any) capital gains as it was my PPOR initially and will be exempt for capital gains for a few years yet. My second investment property will incur some capital gains I am sure, but again I am not expecting a significant rise in property value so it will hopefully not be too much. I believe assuming a capital appreciation of 2.50% for each property is conservative enough to also allow for capital gains as well.

Calculations

I played around with the inputs to determine what arrangement would give me the results I would be looking for. It is difficult to find an easy way to optimise, as there are so many different variables and some of them can have quite a significant impact. The inputs above met all the FIRE requirements I outlined before.

Results

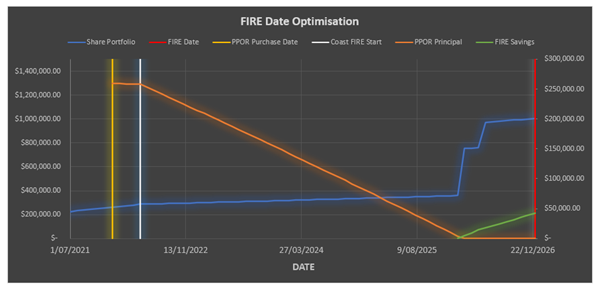

There is a bit going on in the above graph, but I will try and explain all the different lines.

Share Portfolio:

This tracks the value of the share portfolio between now and my FIRE Date. After 11 months, regular contributions cease (indicated by the white Coast FIRE Start line). There are big jumps towards the end when IP 1 and IP 2 are sold.

At FIRE Date the Share Portfolio is valued at $1,005,534.02 (over the $1,000,000 target)

PPOR Principal:

This line tracks my Principal on the PPOR that I purchase on 1/1/2022 (indicated by the yellow line). Initially the repayments are slow until the Coast FIRE starts and the repayments are then made towards the PPOR until the principal is paid off.

Principal is expected to be paid off by 1/3/2026 (9 months before FIRE date achieved)

FIRE Savings:

Once the PPOR is paid off, my monthly savings (including rental returns) will be put towards building a nest-egg for my expenses when I do start FIRE, so I can hopefully leave my share portfolio compounding slightly longer.

Savings will start after 1/3/2026 and the 9 months of savings will be approximately $42,250.00 (greater than the $40,000 target).

Summary

With these inputs, I was able to reach all of my inputs, although a lot of them only BARELY make it. So, if I am slightly optimistic with some of my assumptions, then it would mean that I would not reach all my targets.

I have conducted a bit of a sensitivity analysis, and there were a few inputs that even if changed slightly did end up with significant changes in the results. For example, the expected rent from my PPOR changed results dramatically if it were only reduced to $800 per month instead of $1,000 (that would give me a FIRE savings of only $27,650.00 instead of $43,500.00 at my FIRE start date).

If it was absolutely imperative that I reach FIRE by 5/1/2027 then I would definitely be a lot more conservative, but as it is, it would not concern me if I had to work for an extra 6 months to a year just to make sure I was starting my FIRE right.

Conclusion

Forecasting and planning for the future is an important task, but your predictions are only as good as the inputs you use. Sometimes it is difficult to make accurate assumptions given the unpredictability of the future. I have said many times before that flexibility is one of the most important attributes for anyone to have on their FIRE journey. You need to be able to adapt to changes that are thrown your way and amend your plans to suit.

At the moment, I have the current plan, and that is important that I have something to aim for and I can also use this to help track my own journey to make sure it stays relatively close to where I want it to be. But if there is a drastic change somewhere along the line (for instance, maybe I fall in love with a PPOR that is $50,000 over my price estimation), I am more than willing to adapt to make sure that I give myself the best chance to have a safe and enjoyable post-FIRE life.