Buying My Retirement PPOR – Now or Later?

When I retire, my current plan is to have zero debt and to not be renting, and particularly, I want to have zero debt owing on my PPOR. Now, currently, I do not own a PPOR, so I must ask myself – When do I buy my PPOR?

First, I must state that I do not plan at all to purchase where I currently live. Although I do really like the area, for a property I want in my retirement, it would be a long way out of my price range and not something that I would be prepared to undertake. That means I will be buying a property in an area I cannot realistically live in while I am still working.

This leaves me with options at either end of the spectrum:

Option 1 – Buy a property now using a loan, treat it as an IP until I retire.

Option 2 – Continue to save and invest until retirement and purchase outright.

Each option has its own pros and cons, but for this particular exercise, I wanted to just look at the financial impact of each option. Obviously, predicting the future comes with its own risk, but we can only use our best judgement to try and give ourselves the most realistic outcome for the future. Or at the very least, model different scenarios and make a judgement based on the potentially different outcomes.

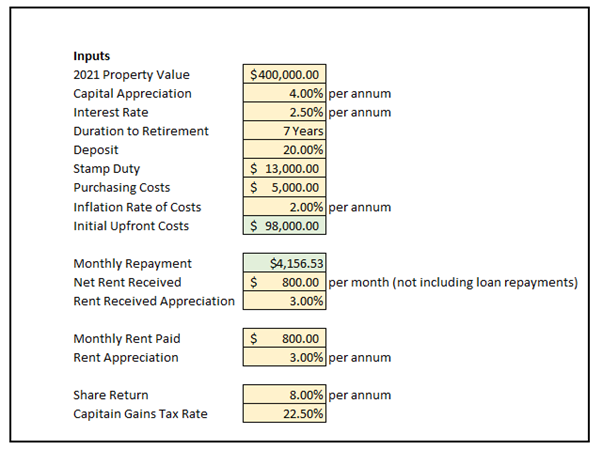

Inputs

I need to look at what inputs I want to have for my spreadsheet to be able to carry out these forecasts. Ideally, I want to make it as simplistic as possible, so I do not overcomplicate it, but also still provide a good financial analysis of each scenario.

Input Summary

2021 Property Value: Typical property value in today’s market I would be looking at purchasing

Capital Appreciation: Per annum growth in property value (this is a big input to play around with to look at long term impacts). This will also provide the value of the property bought for Option 2.

Interest Rate: Interest rate for mortgage

Duration to Retirement: How long until I plan to retire

Deposit: Deposit used for mortgage

Stamp Duty: Stamp Duty for property purchase

Purchasing Costs: Other costs for property purchase (inspections, conveyancing fees etc)

Inflation Rate of Costs: Change in the above costs over time

Initial Upfront Cost: Calculated summary for total outlay required for Option 1

Monthly Repayment: Calculated monthly repayment needed to pay loan before retirement starts. This number also becomes the amount invested for Option 2.

Net Rent Received: Rent received from PPOR as it acts as an IP until retirement – this is after all property costs have been taken out

Rent Received Appreciation: Annual growth in rent received

Monthly Rent Paid: Rent I will need to pay until retirement

Rent Appreciation: Annual growth in the rent I will pay

Share Return: Per Annum growth when investing in shares

Capital Gains Tax Rate: This input only impacts Option 2 when there is a significant selling of shares to purchase a property outright

So that is a list of all the inputs and a brief description of what each input actually does with regards to the calculations.

The amount invested into shares up until retirement for Option 2 is based on the monthly repayment for Option 1. For example, in the screenshot the monthly repayment is $4,085.58 in Option 1. So, the monthly investment for Option 2 is based on this number, minus rent paid, so it will be $3,285.58.

Also, there is a significant lump sum deposit at the start for Option 2 to account for the deposit and purchasing costs made upfront for Option 1.

Calculations

The calculations then simulate the inputs over time for a 10-year period to determine which Option provides a higher value at the end of the period. It is a relatively short time period and does provide much time for any significant compound interest to start really snowballing, however I am still curious what sort of results will be produced.

Disclaimer: The calculations do not consider brokerage costs associated with share purchases, nor do they take into account Capital Gains Tax associated with the property in Option 1 – as it will be an investment property for the period up until retirement so it will incur a capital gains tax to be paid when the property is sold.

Results

Below is a table of the total value of each Option over the 10-year period.

The final value after the 10-year period for each option is as follows:

Option 1: $594,000

Option 2: $534,000

You may be asking why the graph plateaus after the 82-month mark, this corresponds with the retirement date. And for the purposes of this calculation, investment into the share market ceases from this point as there are no more mortgage repayments to be made.

The 82-month mark also for Option 2 shows a dramatic drop in value due to purchasing costs associated with buying the property, as well as paying a large capital gains tax bill.

With the inputs used, the there is about a significant financial advantage by going with Option 1 instead of Option 2.

But I do want to look at seeing what the results look like if I do play around with the inputs, in particular I want to look at capital appreciation, because this really has a significant impact on the returns with property.

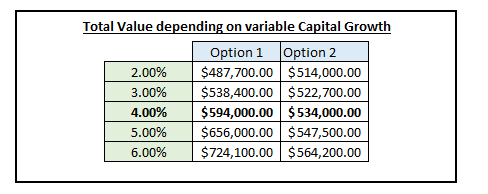

Changing the Capital Appreciation

I want to see what happens if I change the capital appreciation to the following, 2.00%, 3.00%, 5.00% and 6.00%.

Results found in the table below with the total value of each option after the 10-year period.

As expected, the higher the capital growth, the better it is for Option 1, with the growth appearing quite exponential the higher the capital growth is. Of course, it does depend how realistic these sorts of returns actually will be once they are put to the test.

The lower capital growth, it shows that Option 2 becomes a better financial option. With a break-even point around 2.60% where both Option 1 and Option 2 will have the same return after a 10-year period.

Although share return is easier to predict based on historical returns, I want to now look at the impact of this changing this over time on the final value.

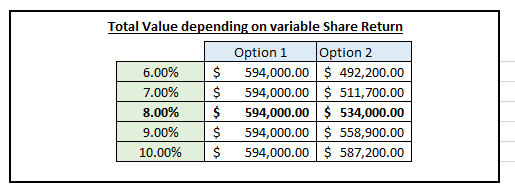

Changing the Share Return

I want to see what happens if I change the share return to the following, 6.00%, 7.00%, 9.00% and 10.00%.

Results found in the table below with the total value of each option after the 10-year period.

The break-even return where both Option 1 and Option 2 provide similar returns after 10-years occurs with a share return around 10.25% per annum. I don’t believe a return of this level is realistic to be achievable.

Conclusion

From looking at the results, you can see that is quite dependent on the inputs to determine what the potential returns will actually end up being for each Option.

Although I did not take into account the capital gains tax that will be needed for Option 1 as the property was an investment property for the initial period of time. This tax would not need to be paid until the property was sold, which could potentially be after I die, it still might be something that needs to be considered.

Weighing up all the pros and cons from a financial perspective, I believe that in my specific case, purchasing a property now will be the preferred option. Currently, my plan is to purchase my retirement home at the start of 2022, and as I write this in April 2021, it gives me about 8 months of research to determine what area I want to retire in.

Non-Financial Pros and Cons

I will not go into too much detail, as I have covered previously pros and cons of renting verse buying in this POST, but for this particular instance, there might be some unique advantages and disadvantages to buying now or later.

Advantages to Buying Now

- Your costs will be known from the start, if you purchase later there is always an unknown of what the price might be in the future. At least if you purchase now, then you can plan better for your future retirement.

- If you purchase a property now, you can start to plan and renovations and changes over time, or carry them out in between tenants so that when you move in you have the place that suits you needs.

- Given interest rates are at historic lows at the moment, you can use this to your advantage and use the banks money to fund your future PPOR. Given I will be paying back the loan in a short time period, the amount of interest paid will be relatively low.

Advantages to Buying Later

- Where I think I want to retire now and where I think I will want to retire in the future might be different. I might end up buying a place now, thinking I will like it, but my desires or circumstances might change and it might no longer be appropriate.

- Always a risk of having bad tenants in your property which could create unnecessary headaches

- Significant property costs might happen between now and retirement which can be frustrating to have to pay for.

Final Conclusion

It cannot be dismissed the importance of non-financial factors when making a decision like this. At this moment I am still leaning towards buying a property now and paying it off over the next 7 years or so. I also recognise, however, that I need to be flexible and I might change my mind in the future. I do hope that if I do change my mind, that it happens before I do make that purchase, as it can be an expensive mistake to make.

One way to mitigate making an expensive mistake, will be to purchase a property which can still provide a good return even if it will not become my retirement property. I can do this by ensuring the property provides a high rental return (positively geared), as well as potential for adding capital gains by way of renovations or other improvements.