The 7 Elements of Generating Wealth

I found the following excerpt in the following book – The Joy of Money by Kate McCallum and Julia Newbound. I will do a full review of the book when I do finish reading it, but in the meantime, I found this section which I found to be incredibly useful and felt it was worth sharing.

HOW TO BE WEALTHY

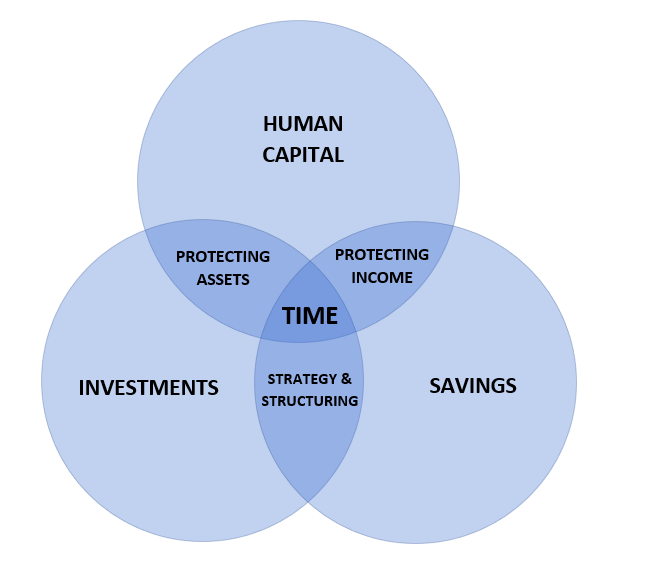

Wealth comes from seven interrelated elements.

1. Your Human Capital

Think of this as your earnings power. This includes what you are able to earn and your ability to work. It is based on your knowledge, skills and competencies – so it is important you invest in and nurture these.

2. Your Regular Savings

Your ability to delay spending and convert part of your earnings into investments.

3. Your Investments

Your financial assets which you should expect to increase in value over time. The good news is that this work is done by your investments while you sleep!

4. Protecting Your Income

Through personal insurances, so that illness or injury does not interrupt your earnings and savings.

5. Strategy and Structuring

Using careful planning to reduce the risk that your money is eroded by avoidable tax and your investments are designed for the right level of risk and a reasonable level of return.

6. Protecting your Assets

Through careful structuring to reduce the risk that your money is damaged by claims and life changes like divorce, remarriage or death. If you are like most people, you do not want assets ending up in limbo, or in the hands of someone you do not want to have them – instead keeping your money with people you do want to have it

7. Time

Which is your lifetime and likely to be the most important driver of your wealth

You will see that time is right at the centre of our diagram. Here’s why:

- The more time you devote to improving your earnings power – both in terms of the money you earn and the hours you work – the more money you have to increase your wealth.

- The longer you work, the longer you delay using your savings to live on – which means you have more money invested

- The more time you have money invested, the longer it can compound and grow

Conclusion

My favourite thing about this concept is that, individually, it seems a whole lot easier to manage and controllable. Each of these elements is fully within your control (for the most part) so these steps can be implemented with ease, rather than just having an overarching goal of “Build Wealth”.

If you look at each step individually, you can streamline each one and make sure you have a solid foundation until eventually you just let time and compounding do it’s thing and let your wealth grow organically.