Stock Picking – February 2022

Each month I will be hypothetically picking individual shares to invest with using a pre-determined criteria outlined in this POST.

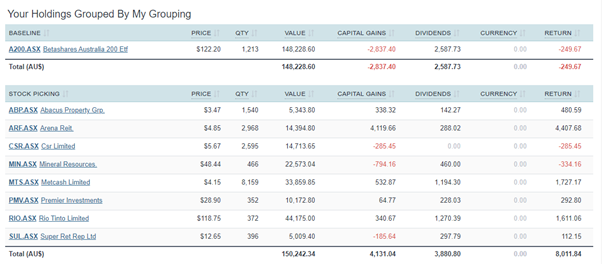

Below is a breakdown of where I currently am on my Stock Picking Simulations. You can find a full summary of the journey since I began in May 2021 HERE

I use Sharesight for tracking of the performances as it is easy to use and is a great tracking tool for shares. The only issue is that I cannot completely separate the stock picking from the baseline comparison, but it is only a small issue and nothing that is going to concern me too much.

Current Performance

Shares Owned – As of 15/2/2022

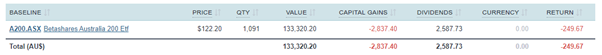

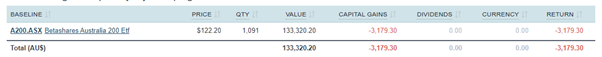

Baseline Comparison – As Of 15/2/2022

As you can see on the above table, Stock Picking is ahead by a few thousand at the moment.

Below is a summary of the performances of each portfolio over the past month – since 15th January 2022.

As you can see, overall, it has been a pretty poor month for all holdings. RIO, SUL and PMV were the only individual listings that were able to increase in value over the past month, with some of the others losing a fair bit of value over the period.

It did not fare much better for the baseline case with A200 as it has also lost a fair bit of value over the same time period.

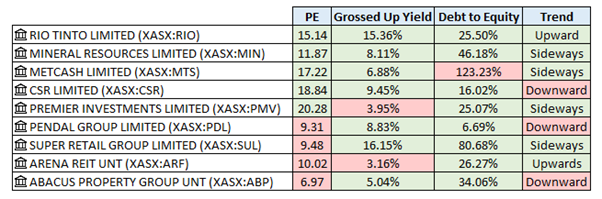

Checking Existing Holdings

1st Criteria: PE Ratio between 11 and 22

2nd Criteria: Grossed Up Yield over 4.50%

3rd Criteria: Maximum Debt to Equity Ratio less than 100%

4th Criteria: 50-day SMA on a five-year chart showing the price not in a downtrend

Above is a table summary of the required criteria.

February 2022 Selection

I mentioned last month that if PDL did not improve it’s price then I would look at offloading that share, it has been a terrible purchase and has gone down significantly in value since I bought it. I will be selling all of my holdings in PDL this month.

With regards to purchasing a new share, RIO and MIN are the only two current listings I have that currently meet the required criteria. Although MIN has gone down the past month, it was still showing a sideways trend on the 50-day SMA.

Next month I will also need to look at weightings of the share I currently have, as I do not want to be too overly weighted in one particular holding, which I feel might be happening with my RIO stock.

Stock Selection

I will make the following selection:

- Sell 2,426 shares of PDL at $4.84 per share for $11,741.84

- Buy 112 shares of RIO at $118.75 per share for $13,300.00

- Buy 276 shares of MIN at $48.44 per share for $13,369.44

My comparison purchase will be 122 shares of A200 at $122.20 per share for $14,908.40

Summary of Holdings in the following table: