September 2021 – Net Worth Update

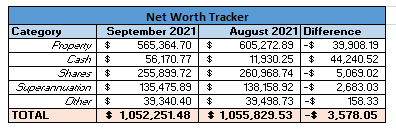

As part of my FIRE blog I will be tracking my net worth on a monthly basis and compare it to where I want to be when I reach my FIRE number. I will also compare it to where it was sitting last month. A summary of my assets are as follows:

Explanation of each category:

Property

There was another decent drop this month, but it is not for the same reasons as last time. There was no change in the value of each property, but I have decided to take out about $40,000 from my offset account and move it into shares. I was initially saving this to potentially buy a house at the start of next year, but I am not thinking I might hold off for a couple years so I can be sure I buy where I want to retire.

I have still kept my emergency fund in the offset account, but the surplus amount will be moved into shares in October.

Cash

As per the above, the cash has come out of my offset account and is now sitting in my bank account. I will move it into shares shortly but at this point in time it is currently making my cash part of my net worth look overly inflated.

I have also been able to move all of my money back from the US to Australia, so that has helped to simplify things and going forward I should be able to maintain a balance of less than $5,000 in my cash account.

Shares

I guess all good things must come to an end, it had been a ridiculous amount of months in a row that there were positive movements in the share market, but alas it is no more. Unfortunately, there was a bit of a drop this month, so the share balance has gone down slightly.

Although if you fast forward another day there was about a $7,000 drop just in one day! So next month’s net worth summary could look very interesting.

Superannuation

Similar to the shares, there has been a bit of a drop in the superannuation balance over the past month.

Other

Not much of a change here

September 2021 Budget Summary

Income – TOTAL: $9,810.15

- Normal Income: $5,105.00

- IP Income: $4,480.15

- Other Income: $225.00

Expenses – TOTAL: $2,797.71

- Normal Expenses: $2,023.14

- IP Expenses (not including Interest): $774.57

- IP Interest: $981.51

Savings Rate – +61.48%

Good to be back on the plus side in terms of savings rate, unlike the disaster that was last month! I do not think it will last too long however as I will have a large tax bill to pay in October, so it won’t look too pretty next month I am sure.

September has boosted my overall savings rate for 2021 down to 45.10% – which is still above my target of 40.00%, I just hope there are no more unexpected surprises to come down the line. With only 3 months left I should be able to reach the goal, which I will be pretty happy about!

I also like to track my income and compare it to my passive income, including my gains for the month.

September Normal Income – $5,105.00

September Net IP Income – $2,724.07

September Net Shares Gain – -$5,069.02

Total Passive Income – -$2,344.95

This is the first time since February that my passive income has actually been negative, and it is quite substantially negative. The drop in the share market really took a hit on this number.

Plan for October 2021

I have a few things to look at in the next month. Lockdown will be ending which will be fantastic as I am getting a bit over this whole cooped up feeling. Might have to start booking some holidays.

I also have my tax bill to pay for last financial year, which will not be pleasant, but it needs to be done! I am not to upset about paying a significant tax bill, it just means I made money.

Apart from that I will just purchase a fair amount of shares over the next couple of weeks so it will definitely boost my share balance and should be able to be close to $300,000.00 in my share portfolio, and I always like to reach a new milestone!