2021 Annual Financial Summary

I like to use the end of the year to have a look at how I performed financially over the past 12 months. I also like to look at other aspects of my life, but for the purposes of this blog I will just focus on the financial component.

I can also look back at the goals I set for myself at the start of the year and see how I tracked against them.

2021 Financial Goals

- Reduce Total Mortgage to $400,000.00

At the start of the year my mortgage was $460,917.98. At the end of the year my mortgage will be approximately $441,277.59.

I did not meet this goal, but I did make the financial decision earlier on the year to transfer $40,000.00 from my offset account into my share portfolio, so I am not too concerned not to have met this financial goal.

- Increase Share Portfolio to $250,000.00

My portfolio at the start of the year was $137,623.08. At the end of the year it is $332,278.27. This is over $80,000.00 above the target. Although I will note that I did decide to move $40,000.00 from the offset account, but regardless it was still able to well exceed the target.

One thing I will note is that this goal has a lot of things outside of my control, and instead of setting a target for a share portfolio amount, I might instead have something regarding additional investments for the year as that is something I can actually control.

- Increase Net Worth to $1,100.000.00

My net worth did increase to $1,100.000 for a period of time through the year, but it is currently just below at $1,083.008.70. Again, this goal is not great as there is a lot of things that are outside of my control. It has still been a great year as my net worth has increased by almost $160,000.00.

- Increase Superannuation to $130,000.00

This goal has been achieved and my superannuation balance currently sits at $142,774.77 which is well in excess of the target. Again, it is on the back of significant share market gains.

- Net Passive Rental Income of $30,000.00

For 2021 I was able to receive Net Rental Income of $33,861.42 so this was another success. I will mention that this figure does not take into account Interest repayments on the loan.

- Savings Rate of 40.00%

Through the 12-month period I was able to obtain a savings rate of 42.12%, so slightly higher than my target but it was somewhat challenging to reach the target. I will mention that a couple of months ago I had a large Tax to pay and initially I counted it as an expense and it drastically reduced my savings rate, I did not feel this was accurate and instead I used the tax bill to reduce my income. In reality it makes no difference, but it does let me reach my target savings rate at least.

2021 Goal Summary

Overall, I am happy with how I went with my goals for the year. The main one that I am most pleased with is the savings rate. A lot of the other ones were on the back of a booming year in the share market, so while it is nice to have reached the goal, if it was not such a great year it might have told a different story. In the future I might look at restructuring the goals so that they are something that I am more in control of rather than relying on share market or real estate market influences.

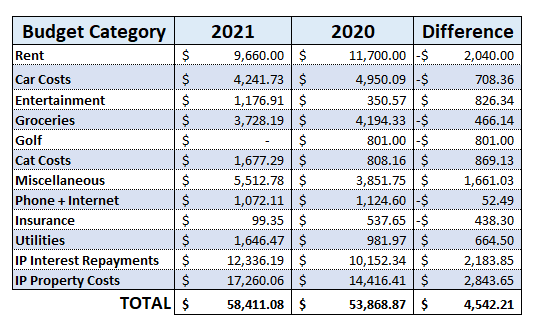

2021 Expense Summary

Above is a table breaking down my expenses for the year, the overall total for this year is $4,542.21 more than it was in the year 2020. But it is important to know that I only bought my second IP during the middle of 2021, so it looks like my actual expenses were quite similar, if not a little less.

If I take away the IP costs, then my living costs for 2021 were $28,814.83 compared to $29,300.12 for 2020. As you can see the numbers are very similar so it looks like I have been able to maintain my cost of living for the most part over the year.

I will have a look at the major expenses and see if I can also predict what might happen in 2022

Rent – This went down for 2021 as for the majority of the year I was sharing my rent expenses. Unfortunately, this is not the case anymore so my rent for 2022 will no doubt increase quite substantially.

Car Costs – I was surprised my car costs were lower than 2020 as I thought I had a few expensive issues, but I must have forgotten about a lot of my expenses from the previous year. Selling my second car late in 2021 will no doubt help me reduce costs in 2022.

Cat Costs – I got a second cat at the end of 2020, so it makes sense that the costs of this category doubled. I have no intention of getting more pets for the foreseeable future so hopefully these costs stagnant.

Miscellaneous – I think the main expense this year was buying a new Television. I used to be concerned with additional expenses which were more luxury than necessity, but I have realised that being relatively close to my FIRE goal I can afford to spend a little more than I would normally, and it will not have such a significant impact on my FIRE goals.

Groceries – These have reduced by about $10 per week, not sure of the reason why but I am conscious of keeping my grocery bill down as much as possible, but without impacting my quality of life.

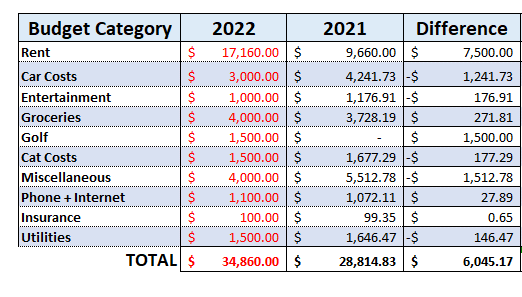

Golf – I did not play golf in 2021, hence not having any money in this category. I will be looking at playing more in 2022 though so this number will most likely go up.

2022 Budget

As you can see, I am expecting my overall expenses to go up quite considerably, but this is mainly due to my rental expense increasing significantly. It will be interesting to come back at the end of 2022 and compare to where I actually end up.

I will note that my FIRE number is currently to allow for $50,000.00 per annum, and that would include living in a home with no mortgage repayments. I feel like I am more than comfortable to be able to live off that amount, but I will keep track and monitor with inflation.

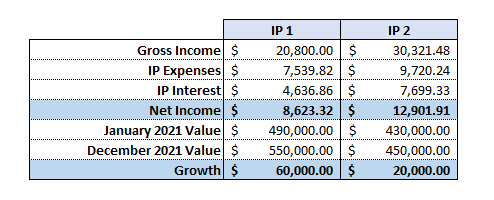

Investment Property Performance

I will now have a look at how my investment properties have performed over the year. My goal with the investment properties is to obtain positive cashflow, so any capital gain is more of a bonus, with a greater focus on receiving positive cashflow.

The above table summarises the performance of each of the investment properties. Overall, I have been quite happy with how they have performed. The current value of IP 1 fluctuates considerable, but I believe $550,000.00 is pretty accurate to the true value.

Both of the properties have provided me with significant passive income which has been invested in the share market to allow me to accelerate in growing that portfolio.

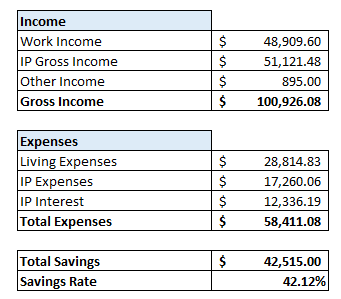

Income Expense Summary

The below table provides a summary of my net income (after tax) and my expenses to show my savings rate.

Interesting to see that my passive gross income has overtaken my work income for the year. This does not actually include any of the income received from dividends either, so it really is showing that I have my money working pretty hard for me these days.

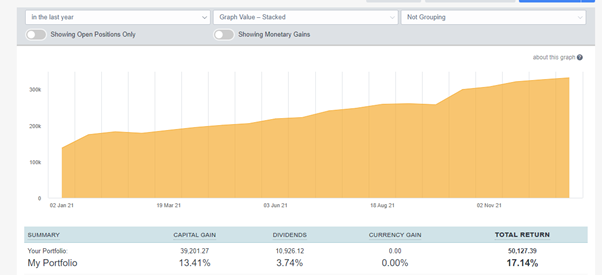

Share Performance Summary

The above shows a snapshot of my share performance from Sharesight. As you can see for the most part, it has been in a solid upward direction. I know I cannot expect this to happen every year, but I will definitely enjoy it while it lasts.

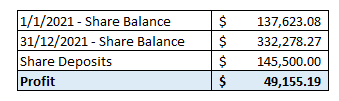

The above table shows how much of a profit I made for the year, approximately $50,000.00 or around 17.14% per annum (according to Sharesight which I will trust is accurate enough).

I had a relatively busy year moving funds mainly back from the US into Australia, and as well as moving some from my offset account into my share portfolio, so I definitely will not be able to replicate depositing $145,500.00 every year.

In 2022 I will hope to be able to deposit around $40,000.00. If I am able to achieve that amount deposited through the year, I will be pretty happy.

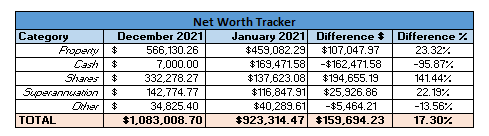

2021 Net Worth Change

Above is a breakdown in my Net Worth compared from the start of 2021 to the end of 2021.

As you can see there was an almost $160,000.00 improvement, over 17% per annum return which is incredible and better than I could have hoped for.

Property, Shares and Superannuation all had strong improvements for the year. A reduction in Cash does not concern me as I was in the process of moving money back from the US and the majority of this was transferred into the share market.

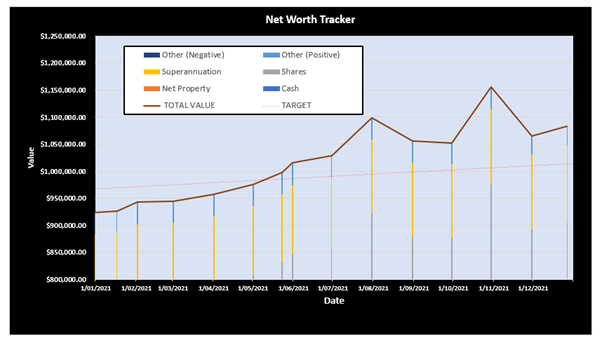

The above graph shows the trajectory of the growth over the year. Overall, it is trending in an upward direction but there has been a couple of significant gains and falls over the year. This was mostly due to property values being quite erratic for IP1.

FIRE Possibility

One thing I also do like to do is see is how close I would be to FIRE if I was to really get sick of work (cannot see it happening anytime soon but just in case).

If I was to move into IP1, keep IP2 as rental income, and sell as many shares as I would need to pay off the mortgage to IP1 what position would it leave me in. I will ignore CGT just for simplicity, it is only hypothetical so does not have to be terribly accurate.

Mortgage remaining on IP1 is currently $161,000.00 This would leave me with a share portfolio of $171,000.00.

Using the 4.00% rule, this would provide me with approximately $6,840.00 per annum of income.

Adding this to my Net Income from IP2 ($12,901.98) I would have a total Net Income of approximately $19,800.00. This is obviously a long way short of the $50,000.00 I was aiming for.

My expenses without Rent being included were just over $19,000.00. So theoretically, I might be able to survive, but it would be Lean FIRE, or maybe even Lean+ FIRE because I would need to be quite frugal if I was hoping to survive.

Anyway, it would not be the most fulfilling life and does not allow any room for emergencies, but worst-case scenario, I would be able to reach FIRE right now if I really had to.

I also did not include my Superannuation in the above calculations, and that would most likely be quite helpful when I did get to preservation age.

Summary

2021 has been a great year for me financially speaking. More than just the numbers though, I have been able to simplify my finances considerably to what they were 12 months ago. I am in the final run towards FIRE now and I feel I have a lot of things set up that it will be a fairly simple transition once I am able to reach it.

I do not believe that finances need to be overly complicated, and that a simple straightforward set up can work just as effectively as a fancy one, at least for someone in my position.

I still have a few years to go yet before I do reach my goal, but I am confident I am making all the right decisions and am going in the right direction.