2020 Annual Expense Summary

One of the first things I decided to do when I started earning significant amounts of money (and by this, I mean when I started working full time), was to create a budget and began tracking my expenses for the year. In a future post I will go through in more details the benefits of creating a budget, of tracking expenses. I will also go through what works for me, it may not work for me, but I will go through my system and explain my reasoning.

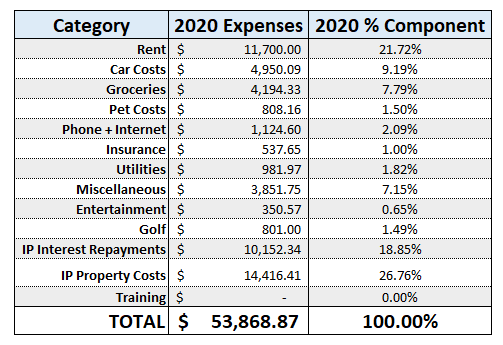

Anyway, below is a summary of my expenses for my 2020 annual spending. I will also compare to where it was last year, to see where I have streamlined my expenses and where I may have become a bit too relaxed:

2020 Expense Summary

As you can see from the above table, a significant portion (over 45%) of my expenses is to cover my Investment Properties (I have two by the way). On a separate post I will go through in detail the profit and expenses of my IPs, so if anyone is considering property as a form of investment, they can get a bit more of a picture about the day-to-day costs of owning an Investment Property.

Probably the biggest component missing in this table is a nice one called TRAVEL, given it was 2020 it did limit travel significantly, and as such I did not really take any holidays. I did take a lot of day trips out to new places however so I did have some balance in my life, but probably not as much as I would have liked. Hopefully in the future I can allocate more time to this part of my life.

2020/2019 Annual Expense Comparison

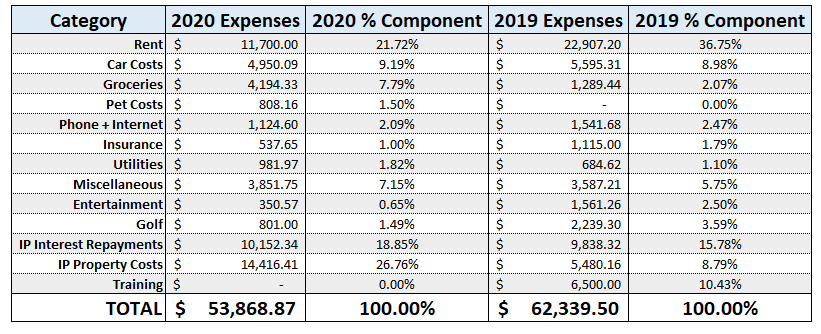

Now to compare to where this was last in 2019 to see if I have made any significant adjustments in my expenses:

Now there are definitely some big changes and as you can see I have been able to remove almost $10,000.00 from my yearly spending.

Rent: I moved at the end of 2019 into somewhere significantly cheaper ($100 per week rent less) and halfway through the year in 2020 my partner moved in with me to share the rent, so my rent has gone from $400 per week down to $150 per week.

Groceries: My groceries in 2019 look abnormally cheap, that was because I ate out a lot more, and I put this under “Entertainment” category. I definitely did not starve I can assure you that. Also, in 2020 I did take a bit more focus on my diet specifically and wanted to make sure I was eating better, rather than just eating cheap food with minimal nutritional value. Finally, I bought myself a cat at the start and end of 2020, and the groceries now also includes their food as well.

Insurance: Early on in 2020 I was reviewing my expenses and looking where I could cut costs. One thing I decided to remove was my Extras Insurance cover, which I have had for a few years but not once used. I kept justifying it because it was ONLY $15 per week, but this never kept going up over time, and in the end it was just not worth it.

Golf: I did play a lot more golf in 2019, I was a member of a club and would play every week just about, when I moved it was difficult to find the table to travel the distance each week to play golf so it fell by the wayside. Towards the end of 2020 I joined a local club where I have moved to and will make sure I do play more. But the membership was already half the cost at the newer club so will already be a significant saving.

IP Expenses: In the middle of 2020 I bought my second IP, and for the first couple weeks I spent a bit of money renovating it getting it ready to be rented out. As well as adding in real estate management fees, letting fees, advertising fees (everything they try to get from you) it has shown a substantial increase in this amount. Obviously, this has come with an increase in income received from my IPs so the increase in expense is not too much of a concern for me.

Training: In 2019 I was undertaking a weekly course, which I completed at the start of 2020, so that is a significant expense which is no longer required.

So that is a bit of a summary of my expenses over the past couple of years, I think it is particularly important to look at your annual expenses so you can try and calculate your FIRE number, the first step of which is to realise how much money you need/want to live off in your retirement each year.

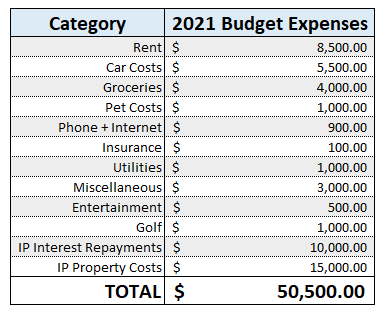

My next step is to look at my budget for 2021. At the moment, I have the following in terms of my expenses.

2021 Forecast Expenses

I am not planning on drastic changes for the year going forward, so hoping that now sharing a place to live with my partner will reduce mainly my rent expenses.

I guess I will check back in 12 months from now and see how everything went!