Difference Between ETFs, LICs, Index Funds and Managed Funds

I probably should have done this post a lot earlier on, because it really is a starting point when you do start learning about investing in the share market. When I started writing this, I had a rough idea what the differences were, but I would be lying if I did know exactly what the differences are. You might have noticed that I quite often substitute ETF and Index Fund when I am talking about investment vehicles, this is probably technically incorrect, which I will explore as part of this post.

There are two separate dimensions associated with the investment fund:

- Legal Structure

- Stock Selection Style

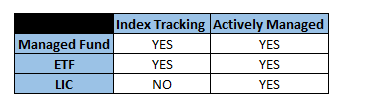

Below is table providing a summary of the different stock selection styles available for ETFs, LICs and Managed Funds

Essentially, a LIC does NOT have the option to be Index Tracking, whereas Managed Funds and ETFs can be either Index Tracking or Actively Managed.

Now, the question is what is the difference between Index Tracking and Actively Managed?

Index Tracking vs Actively Managed

An Index tracks a market.

For example:

The S&P ASX200 Index tracks the 200 largest Australian publicly traded companies

The MSCI World Index tracks the largest 85% of publicly traded companies in 23 developed countries

The MSCI Emerging Markets Index tracks large and mid-cap publicly traded companies in 27 emerging countries

These are tracked by “Market Capitalisation”, which means if one company is valued at double another company, then that company will be weighted as double the proportion.

Market Capitalisation: the value of a company that is traded on the stock market, calculated by multiplying the total number of shares by the present share price.

For example, if you purchase a share in an ASX200 index-tracking fund, you own a piece of Australia’s largest 200 companies in their valuation proportions. Look at this POST where I did a breakdown of A200 and you can see the breakdown of the holdings after purchasing A200.

An Index Fund has NO input from a fund management company with regards to stock selection, they simply track the market as it is, so you are guaranteed the returns (or losses) of the market.

The oppose of an index fund is an actively managed fund – this is where a fund management company selects a subset of stocks.

Legal Structures

The legal structure does not determine what assets the fund does invest in, just about how these assets are held.

- Managed Funds

The company holds the underlying shares and you purchase directly through that company. When you buy or sell a share in the fund, the fund goes and buys/sells the underlying shares of each company in the fund. This ensures that the underlying shares’ value will match what they are worth if you bought them individually.

Both actively managed funds and index-tracking managed funds are available.

Examples of Index Tracking Managed Funds

Vanguard Australian Shares Index Fund

Vanguard International Shares Index Fund

Examples of Actively Managed Funds

Colonial First State FirstChoice Wholesale Australian Share

Colonial First State FirstChoice Wholesale Global Share

- ETFs – Exchange Traded Funds

ETFs are simply listed versions of managed funds. Instead of purchasing directly through the fund management company, you buy a share of the fund on the stock exchange. As per the name, it is a fund that is “exchange-traded.” Again, there are both index-tracking ETFs and actively managed ETFs.

Examples of Index Tracking ETFs

Vanguard Australian Shares Index ETF (VAS)

BetaShares Diversified All Growth ETF (DHHF)

Examples of Actively Managed ETFs

Switzer Dividend Growth Fund (SWTZ)

Fidelity Global Emerging Markets Fund (Managed Fund) FEMX

You will notice that the Actively Managed ETFs typically have significantly higher management fees due to a more hands on approach required in managing them.

- LICs – Listed Investment Companies

The above two types of legal structures are called open-ended funds, in that, as an investor buys or sells shares of the managed fund or ETF, the fund will go and buy/sell more of the underlying shares, so the price tracks the actual value of the underlying shares it holds.

Due to this, a LIC can NOT be an index tracking fund and is always going to be an actively managed fund.

LICs are closed-ended funds, which means that the company purchases or sells the underlying holdings at their discretion. When investors buy shares, no additional shares are created. If there is a high demand for a LIC’s share, the price goes up above the value of the underlying basket of shares within it (called trading at a premium to NAV – net asset value). Conversely, if there is low demand, the LIC’s share price falls below the value of the underlying basket of shares (called trading at a discount to NAV)

LIC Examples

AFI – Australian Foundation Investment Company

ARG – Argo Investments Limited

Summary

A fund has two dimensions – the legal structure and the stock selection style.

The most important decision is the stock selection style – whether to choose an index fund or an active fund.

Choosing between Managed Index Funds and Equivalent Index-Tracking ETFs

For their index-tracking funds, Vanguard offers one managed funds and one ETF

- Vanguard Personal Investor

- ETF

Specifics of Managed Funds

The managed funds allow you to transfer money directly to your fund, so you will be able to avoid brokerage costs to buy and sell. This will mean you do not have to wait to save up for larger chunks like you would for an ETF (to minimise the cost of brokerage).

Managed fund prices update once per day (after market close). Transactions only process once per day (after market close). There is no longer the temptation to check the prices periodically throughout the day as you would have with an ETF. This could prevent potential mental health issues if they become drawn to checking the updated price every minute while the market is open.

You are also able to set up automated payments into your fund, so you will not need to look at your investments at all if you choose not to. Automated investment is a great benefit if you are looking at removing behavioural risk associated with investing.

The fee structure for the managed fund is slightly higher than the ETF equivalent – for example Vanguard Australian Shares Index Fund has a management fee of 0.16%, compared to VAS which has a management fee of 0.10%. There is also a buy/sell spread of 0.05% associated transactions.

Specifics of ETFs

One advantage to ETFs, is that when you purchase a share of an ETF, you pay whatever the price is at the time. In contrast, with managed funds, you put in a purchase order and the shares are bought after the market closes that day, so you may end up paying more or less per share than you intended. However, typically this is not an issue for a long-term investor.

If you have plans to buy or sell large parcels of shares, the cost of the transaction will be cheaper with an ETF due to the flat brokerage compared to the buy/sell spread. For example, the Vanguard Australian Shares Index Fund has a 0.05% buy/sell spread, so if you were to buy/sell $20,000 this would end up costing you $10.00 in transactional costs. Given this is the same as brokerage, anything higher than this amount it becomes more cost effective to go through an ETF.

Tax Advantages of ETF

In managed funds, the entire fund is one pool of assets, so other investors selling their units triggers capital gains for all investors of the fund. Even if you do not sell any units, you are still hit with capital gains. This does not occur with ETFs due to their structure, and instead you defer these capital gains until you sell your ETF shares.

Summary

There are slightly higher fees associated with the Managed Fund compared to the ETF equivalent, and the different tax structure can be a deciding factor. But with no brokerage and convenience of purchasing shares it might be worthwhile for you to invest using the Managed Fund.

Conclusion

I hope this does help clarify the differences between ETFs, LICs, Index Funds and Managed Funds. I know I learnt a bit while I was reading up about the differences.